2019 Bahamas Real Estate Market Report

At the end of 2019 Engel & Volkers Bahamas analyzed the main Bahamian real estate markets and the trends that they have followed over the previous half decade. The goal of our reports is to assist buyers, sellers and industry professionals in achieving their real estate goals based on accurate market metrics and trends which can significantly impact strategic decision making. We feel the Bahamas real estate market lacks accurate and transparent data and we also believe that whether the market is good, bad or flat, there is always a strategy to consider for those who invest in real estate whether for a family home or long term investment objectives.

Our professional advisors are all skilled in helping our clients develop a customized market strategy that can benefit in all types of economic conditions.

Enter your email below to receive a copy of the market report or keep scrolling for the table of contents.

Contents

- Introduction

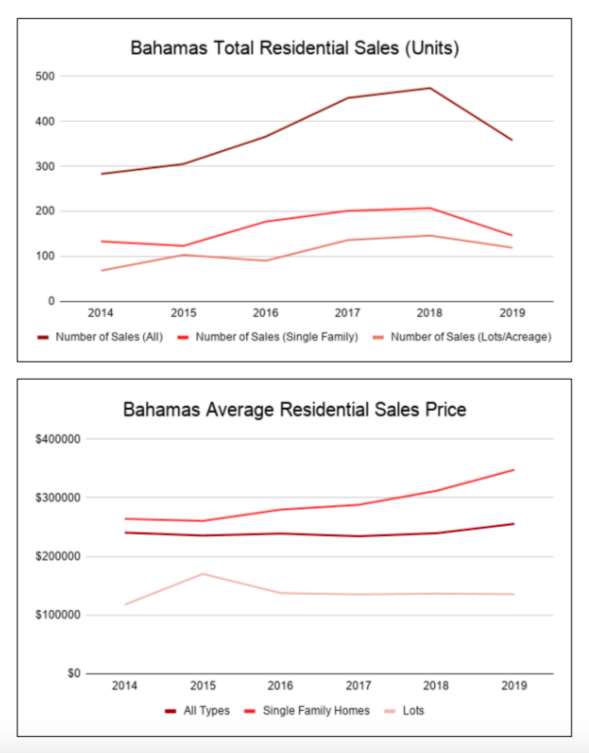

- Bahamas Total Residential Sales (Units) & Avg. Sales Price

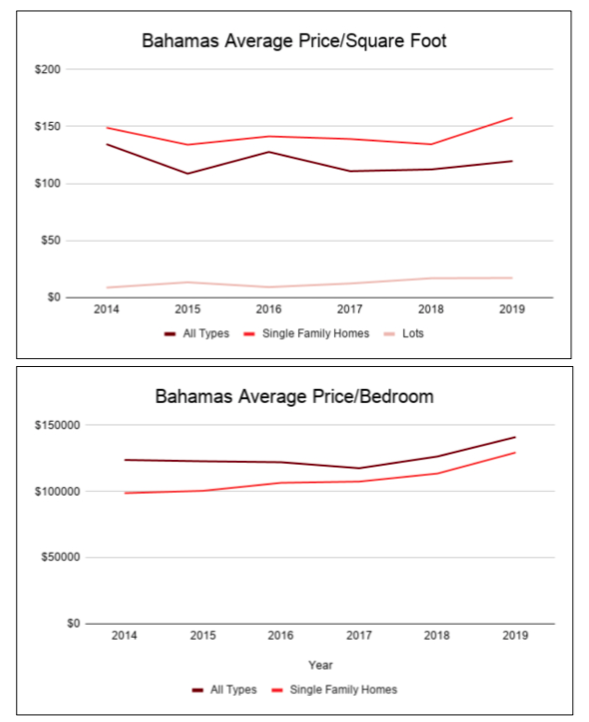

- Bahamas Average Price/Sq.Ft. & Average Price/Bedroom

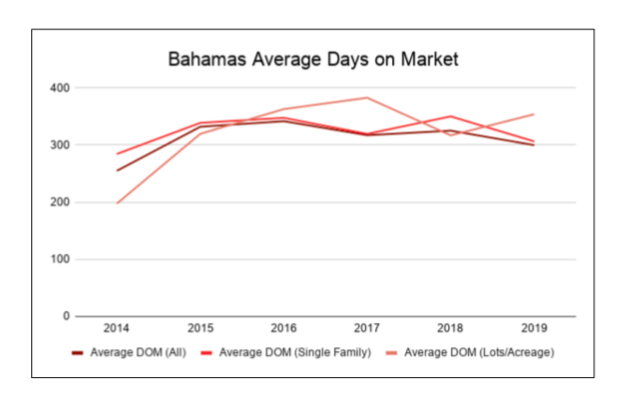

- Bahamas Average Days On Market

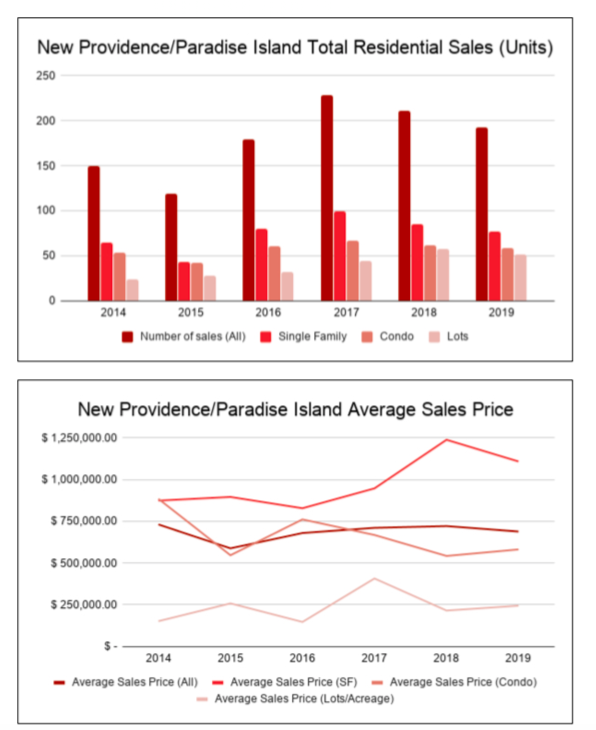

- New Providence/Paradise Is. Total Sales & Average Sales Price

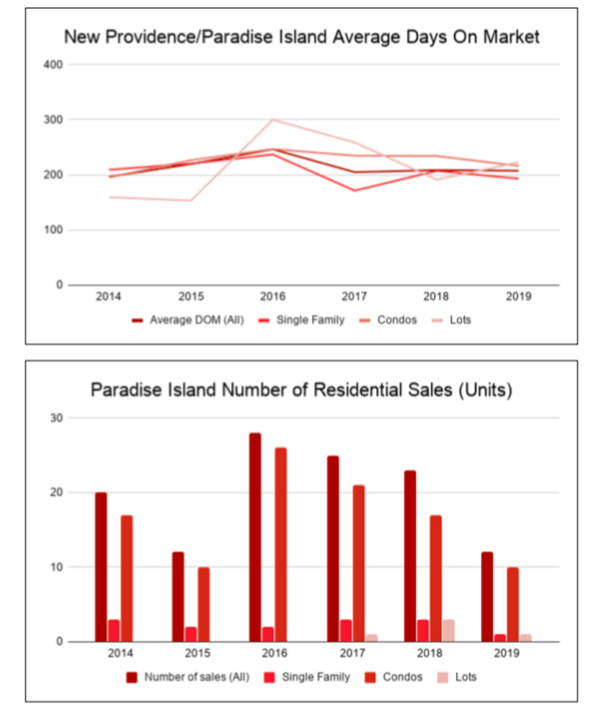

- New Providence/Paradise Is. Average DOM & Paradise Island Sales

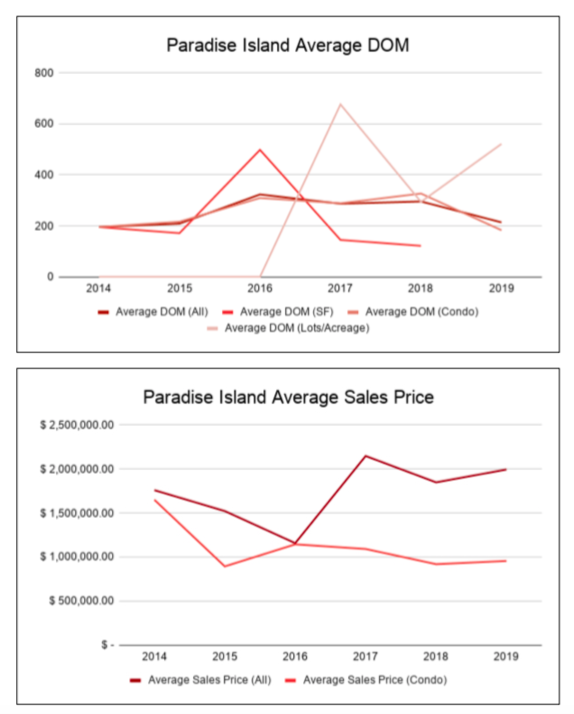

- Paradise Island Average DOM & Average Sales Price

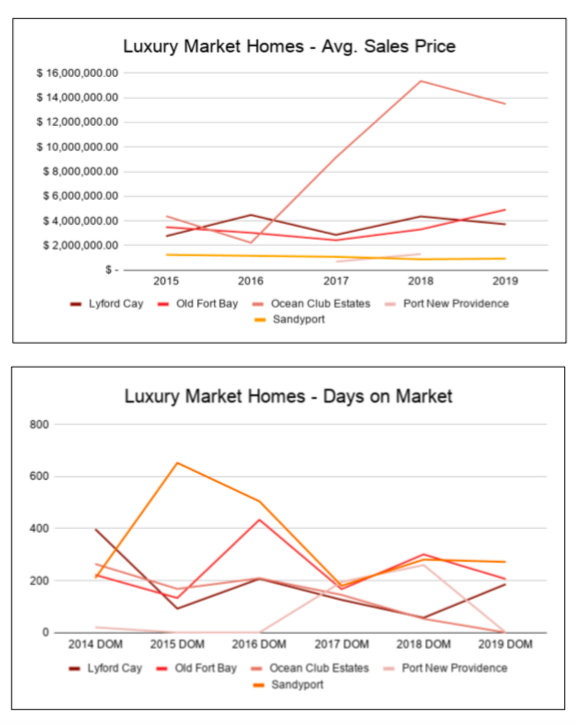

- Luxury Market Homes Average Price & Average DOM

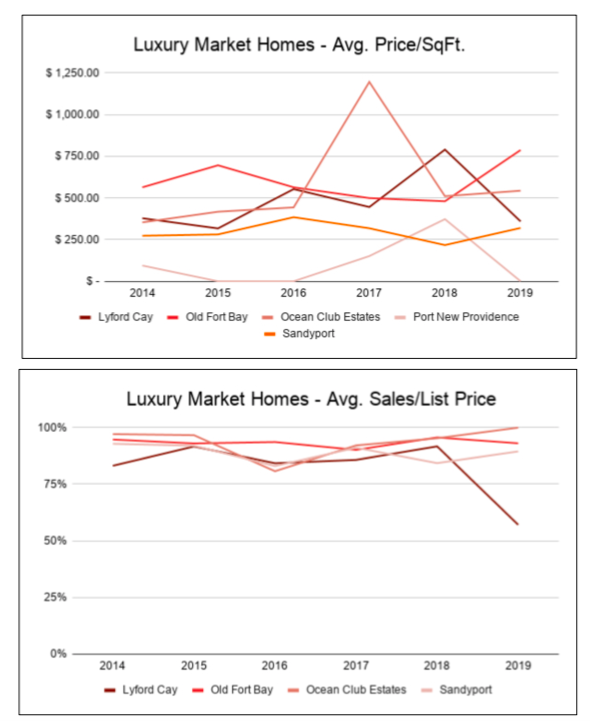

- Luxury Market Homes Average Price/Sq.Ft & Average Sales/List Price

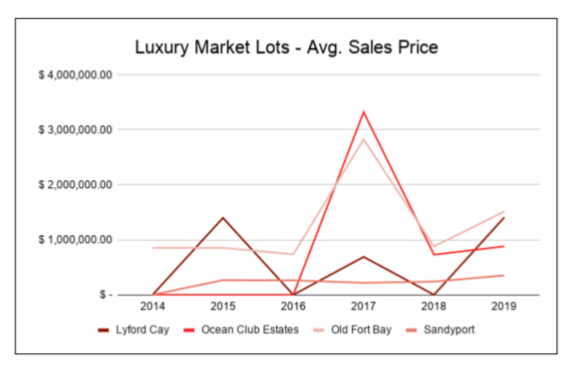

- Luxury Market Lots Average Price

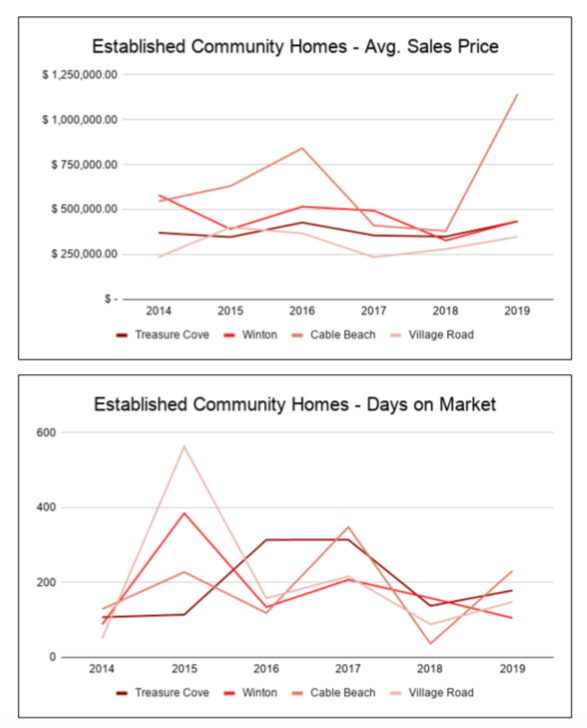

- Established Community Avg. Sales Price & Avg. DOM

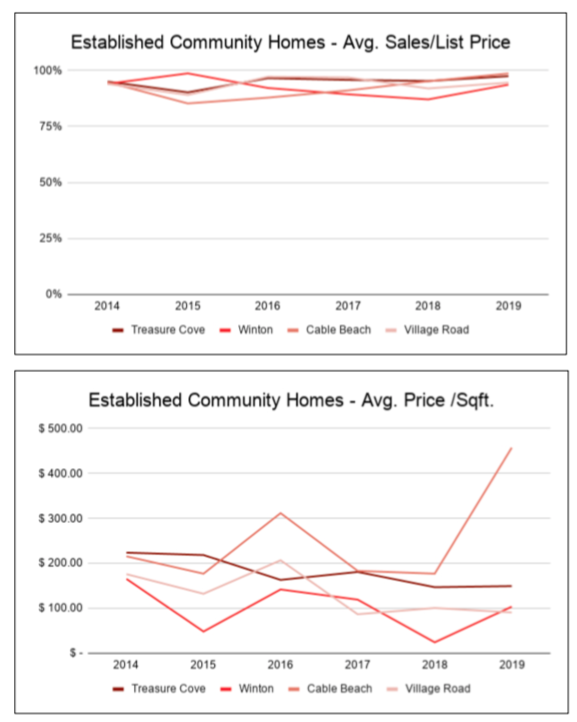

- Established Community Avg. Sale/List Price & Avg. Price/Square Foot

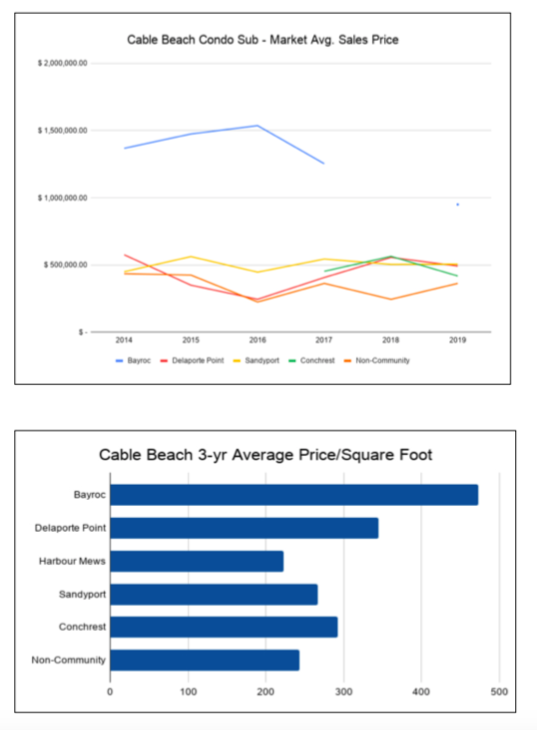

- Cable Beach Sub-Market Avg. Sales Price & 3-Yr Price/Square Foot

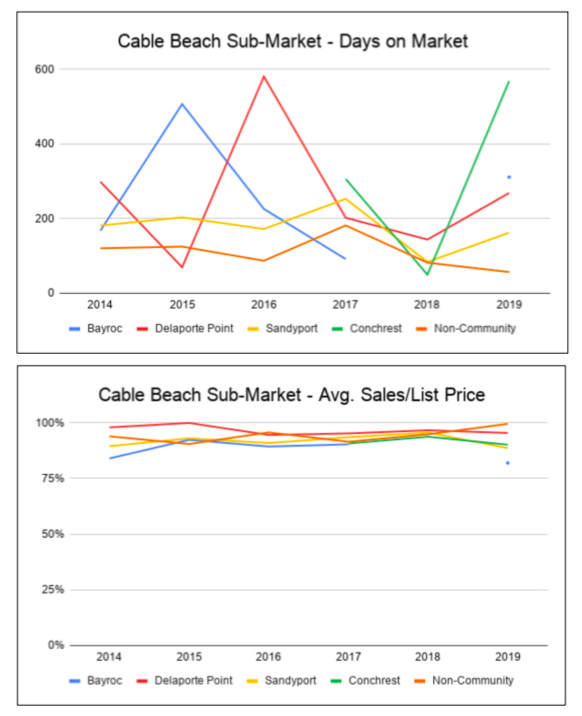

- Cable Beach Sub-Market Avg. DOM & Average Sales/List Price

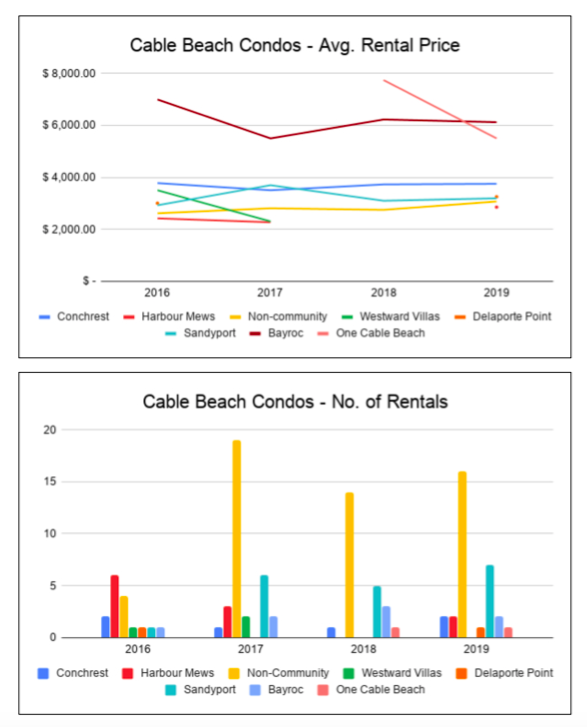

- Cable Beach Condo Rental Prices & Number of Rentals

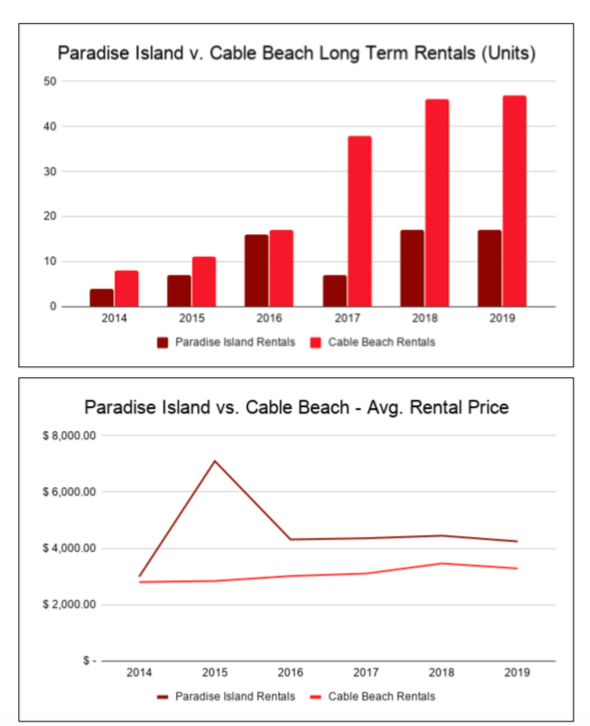

- Paradise Is. vs. Cable Beach Long Term Rental & Average Rental Price

- Paradise Is. vs. Cable Beach Long Term Rental Yield

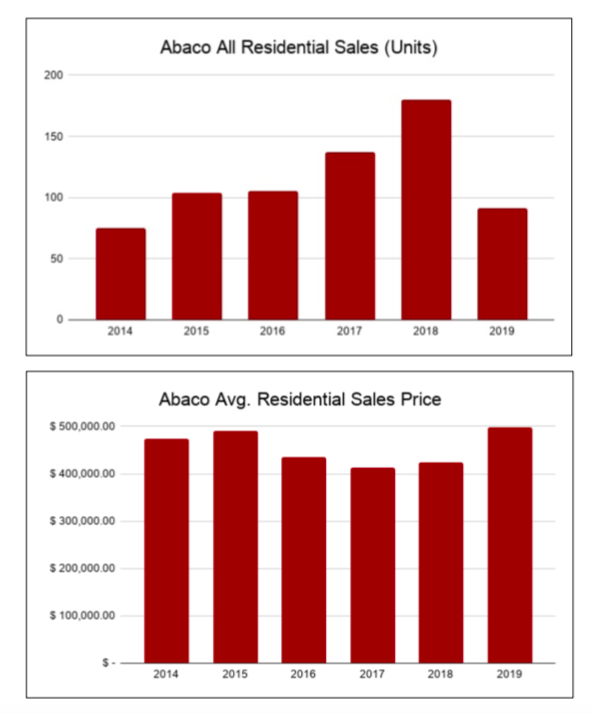

- Abaco Residential Sales & Avg. Sales Price

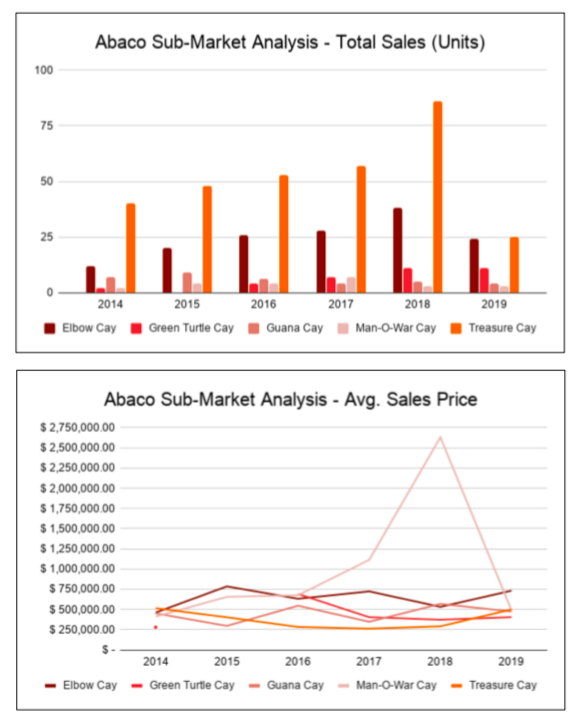

- Abaco Sub-Market Total Sales & Avg. Sales Price

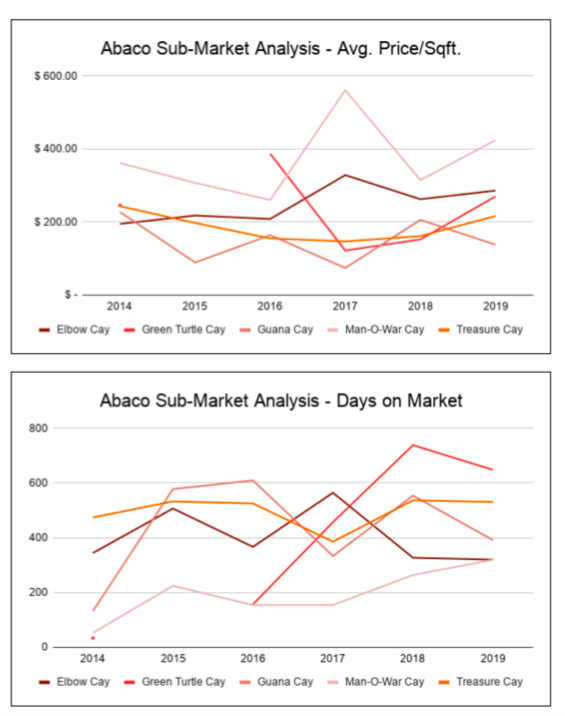

- Abaco Sub-Market Avg. Price/Square Foot & DOM

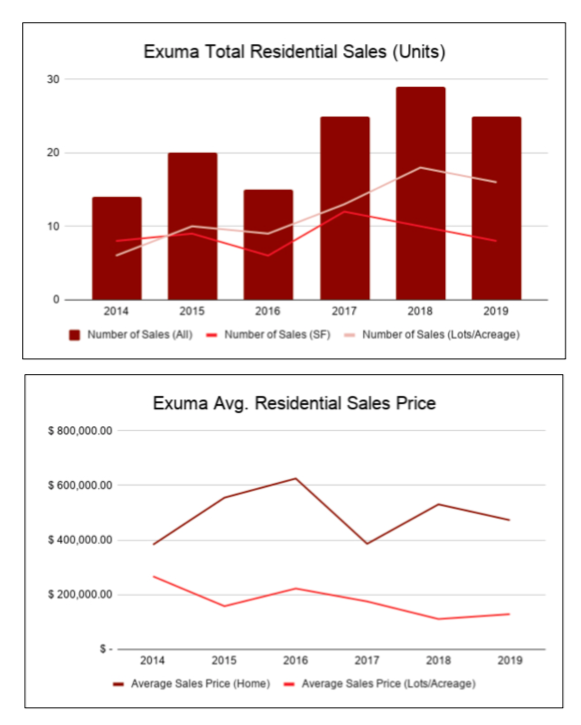

- Exuma Total Sales & Avg. Sales Price

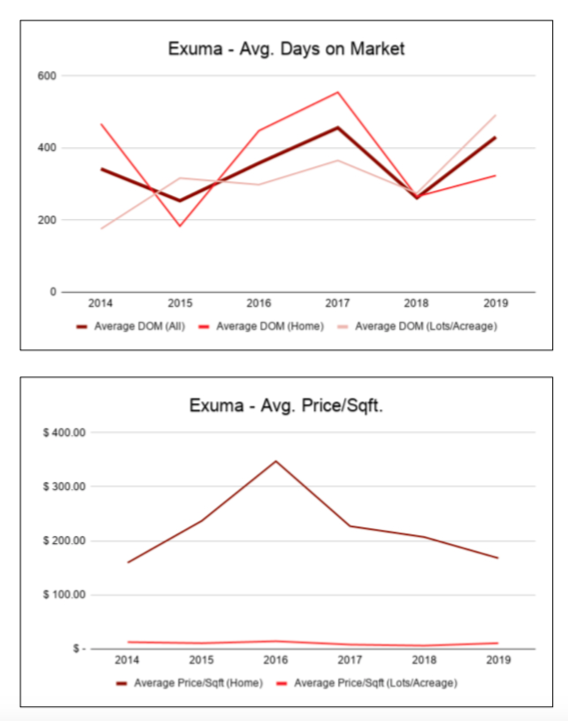

- Exuma Avg. DOM & Price/Square Foot

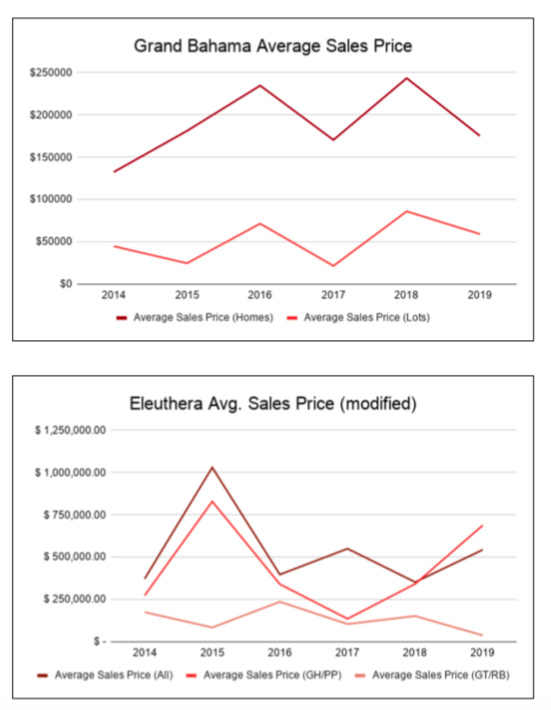

- Grand Bahama Average Sales Price & Eleuthera Avg. Sales Price

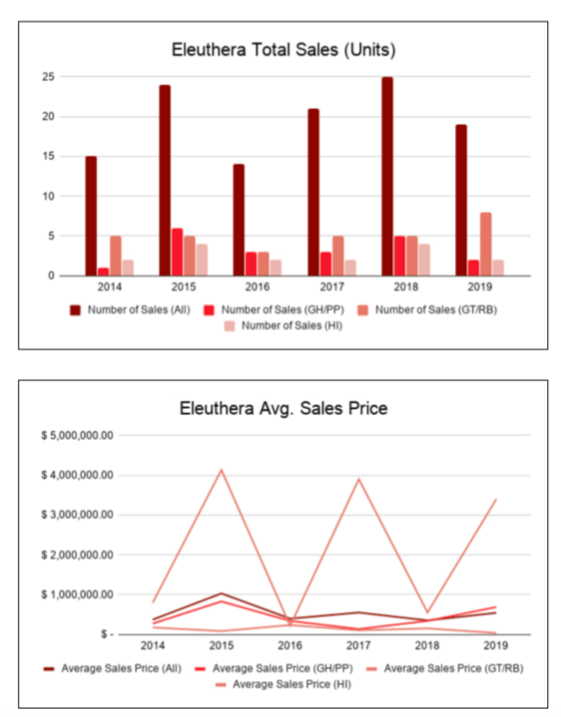

- Eleuthera Total Sales (Units) & Average Sales Price All Residential

- Market Insights

- Real Estate & Conservation

Introduction

At the end of 2019 Engel & Volkers Bahamas analyzed the main Bahamian real estate markets and the trends that they have followed over the previous half decade. The goal of our reports is to assist buyers, sellers and industry professionals in achieving their real estate goals based on accurate market metrics and trends which can significantly impact strategic decision making. We feel the Bahamas real estate market lacks accurate and transparent data and we also believe that whether the market is good, bad or flat, there is always a strategy to consider for those who invest in real estate whether for a family home or long term investment objectives.

Our professional advisors are all skilled in helping our clients develop a customized market strategy that can benefit in all types of economic conditions.

National Forecast

In October, The International Monetary Fund (IMF) slashed The Bahamas' 2019 growth forecast by 50 percent, and projected the economy will contract next year, due to Hurricane Dorian. In the World Economic Outlook report, the Fund said the gross domestic product (GDP) expansion will fall from 1.8 percent to just 0.9 percent for 2019, with the brunt of Hurricane Dorian’s economic fall-out to be felt in 2020 forecasting that the Bahamian economy will shrink by 0.6 percent, compared to previous forecasts for 1.7 percent growth.

While properties in Abaco and Freeport will likely see trading activity for value buys and renovation investments, the other island such as Exuma, Eleuthera and Long Island will likely benefit from those looking to experience their investment immediately or begin generating income without the risk or requirement of surrounding amenities or renovation requirements.

On the capital island of New Providence/Paradise Island, both the luxury market and local market should see strong sales activity. New developments in the high end market bring exciting added value and diverse selection of investment opportunities. Financing in the local market has improved significantly with banks competing aggressively and with sub 4% interest rates. Due to a high level of inventory on the market, price adjustments will be the order of the day and buyers will likely react positively.

Analysis:

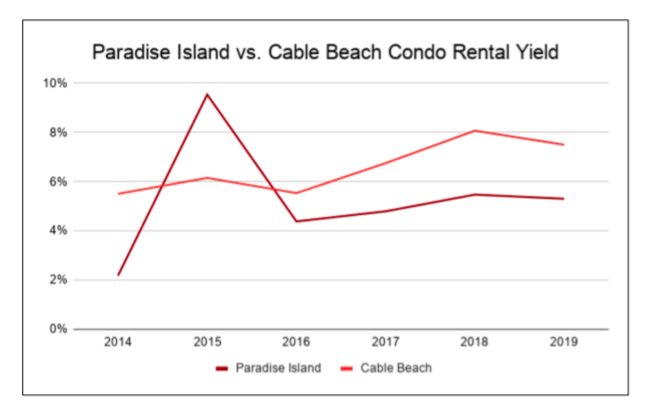

The 2015 spike on Paradise Island were 2 Ocean Club Residences condos that rented at an average of $14,120/month. The Yield averages in this graph are calculated solely by average annual rent and average sales prices in the respective sub markets. Rental properties will perform both better and worse than the averages depending on several factors.

In 2019, the average square feet of a rental apartment on Paradise Island was 1,704 square feet while Cable Beach averaged 1,335 square feet. 29% of Cable Beach rentals and 54% of Paradise Island rentals were at or over $5,000/month. The average days on the market before leasing in Cable Beach was 150 and 115 for Paradise Island. The average list price to lease price ratio in Cable Beach was 94% and 96% for Paradise Island.

Market Insights

New Providence/Paradise Island Luxury Market

The Luxury Market will continue to be strong in 2020 with Price Adjustments being the order of the day and more properties likely to trade on the MLS than in 2019. New luxury condo inventory has flooded the market giving buyers

more negotiating power and willingness to wait for the right deal. 2020 will be a year to present good opportunities to buyers as well as the opportunity for sellers to move their property if they are prepared to work with the market.

New Condo Inventory

Projects like Albany, Goldwynn, The Pointe, Palm Cay, Hurricane Hole, Rosewood and SLS represent over 900 new luxury condo units to the Nassau/Paradise Island market. With several years of inventory between them, price adjustments and incentive heavy negotiations will likely influence 2020 sales and bring good opportunities for buyers.

Cable Beach

Cable Beach was the top performing market on New Providence/Paradise Island in 2019. The condo market average sales price increased 20% while Sandyport improved by 5.8% over 2018. Total units sold increased across the board. The primary contributor to the area is the success of Bahamar as a central amenity and its contribution towards a strong rental market. The trend should continue in 2020.

Abaco & Grand Bahama

Abaco was on another strong track to have a successful 2019 when Dorian ended its run about two-thirds the way into the year. Overall, Green Turtle Cay matched its total 2018 sales in only 8 months with an 8.6% average price increase and Treasure Cay was well off of its 2018 performance. In Grand Bahama, Freeport survived Hurricane Dorian fairly well and offers excellent buying opportunities with discounted prices as a result of the Dorian uncertainty. Royal Caribbean has announced it still proceeding with its hotel plans and talks are underway to upgrade the airport. The prices of real estate currently reflect the risk.

Exuma & Eleuthera

Supported by short term rental markets, developing amenities and the affects Dorian had on the northern islands, Exuma and Eleuthera should see more sales activity than in 2019. Buyers seek a turn-key waterfront home in close proximity to amenities and activities while looking for a good value or returns on the investment.

Undeveloped/Developing islands

The developing islands continue to be a buyers market because of low airlift, lack of amenities and inconsistent infrastructure. Opportunities exist to get more bang for your buck and data proves that vacation renters will come from further away for longer periods of time to stay in a quality, comfortable well serviced property. Long Island, Cat Island, Berry Islands, Andros and San Salvador all offer great value, authentic nature based life styles which has been a growing trend internationally in recent years.

REAL ESTATE THAT BENEFITS FROM A WORLD CLASS MARINE ENVIRONMENT

“The national park system of The Bahamas, comprising approximately 2.2 million acres of both terrestrial and marine areas, was created, and is managed by, The Bahamas National Trust, a private-public collaboration established by an act of Parliament in 1959.

Uniquely, the Trust is the only such non-governmental entity in the world responsible for the management of a country's national park system.

In 2019, the BNT will celebrate its 60th anniversary. During the past six decades, the Trust has helped to: "conserve and protect Bahamian natural resources", while serving as a "powerful force for [regional] and global biodiversity conservation.”

Through passion and courage, a commitment to education and excellence, respect for others, and through integrity, transparency and accountability the Trust has helped to conserve and celebrate the archipelago of biodiversity that is our common wealth of national parks and protected areas.

Over the next five years, the Government of the Bahamas will collaborate with the Trust as it implements the 2018-2022 Strategic Plan. This will include ongoing efforts to address climate change, combating the effects of plastics on our environment, and other measures to conserve our natural environment and to educate Bahamians about our shared environmental trust.” Dr. The Hon. Hubert A. Minnis, Prime Minister Of The Bahamas

Over the next five years, the Government of the Bahamas will collaborate with the Trust as it implements the 2018-2022 Strategic Plan. This will include ongoing efforts to address climate change, combating the effects of plastics on our environment, and other measures to conserve our natural environment and to educate Bahamians about our shared environmental trust.” Dr. The Hon. Hubert A. Minnis, Prime Minister Of The Bahamas

The Bahamas National Trust plays a critical role in safeguarding the biodiversity of The Bahamas as well as the function of its ecosystems and the services they provide to Bahamian people. The Bahamas National Trust also plays a pivotal role in supporting research efforts to better understand the species and ecosystems of The Bahamas and developing the tools and strategies needed to protect and restore them.

Dr. Craig Dahlgren - Perry Institute for Marine Science

Disclaimer & Copyright

The data provided in this report is sourced from the Bahamas Multiple Listing (MLS) service which is supported by a network of licensed real estate agents in The Bahamas. Engel & Volkers makes no guarantees that the data entered in the MLS is always correct. The data is supplied from the MLS as of the first week of January 2020. These sales do not represent 100% of the market transactions and would exclude distressed sales, foreclosures, sales by private owners, new development condos and community sales where the developer is not a part of the MLS and other situations where realtors are not a part of the transaction or the sale is not an MLS listing. We do however believe that overall the data serves as the most reliable public source for arms length transactions that are public knowledge. The concept of an arm's length transaction assures that both buyer and seller are acting in their own self-interest and are not subject to any pressure or duress from the other party. It also assures third parties that there is no collusion between the buyer and seller. Engel Völkers Bahamas makes no statement, representation, or warranty and assumes no legal liability in relation to the accuracy, context or suitability for any purpose of the information provided through use of the 2019 Market Report. Publication of this report or the content herein of this report or the content herein is not permitted without the prior written consent of Engel & Volkers Bahamas.